May 9, 2024

In a remarkable turn of events, the financial markets witnessed significant movements in gold, bonds, and stocks following the release of less-than-stellar economic data on what was anticipated to be the quietest trading day of the year. This surge provides a unique perspective for investors and traders alike, highlighting the often unpredictable nature of the financial world.

Analyzing the ‘Bad’ Data Impact

On May 8, 2024, various economic reports indicating weaker-than-expected performance in sectors such as manufacturing and retail sales were released. Traditionally, such ‘bad’ data would suggest a slowing economy, prompting investors to brace for potential market downturns. However, contrary to expectations, the markets responded positively, with gold, bonds, and stocks all experiencing a notable rally.

The Gold Rush: A Safe Haven Amid Uncertainty

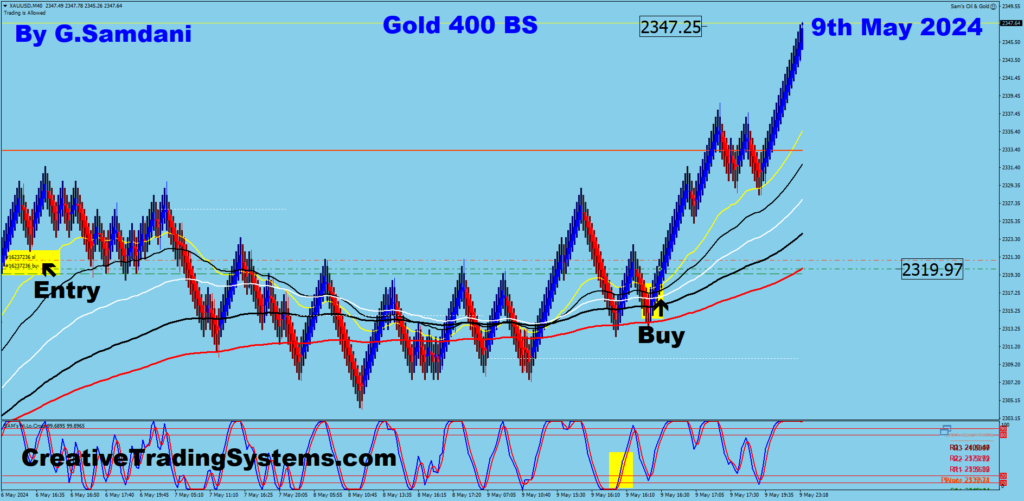

Gold, often regarded as a safe-haven asset during times of economic uncertainty, saw its prices jump significantly. Investors flock to gold as it provides a hedge against inflation and currency devaluation, factors that become considerable concerns during economic slowdowns. This surge in gold prices reflects a classic defensive strategy, where investors seek stability in the face of uncertain economic forecasts.

Bond Market’s Bullish Turn

Similarly, the bond market reacted positively to the ‘bad’ data, with an increase in bond prices and a corresponding decrease in yields. This movement can be attributed to expectations of a more dovish monetary policy stance from central banks. If the economy is indeed slowing, policy makers might lower interest rates or implement more accommodative policies to stimulate growth, making bonds an attractive investment.

Stocks Defy Expectations

The stock market’s response was perhaps the most surprising. Typically, stocks would falter under the cloud of poor economic data, but on this occasion, major indices like the S&P 500 and the Dow Jones Industrial Average rallied. This counterintuitive rise in stock prices might be due to a mix of factors including the potential for lower interest rates, corporate earnings resilience, and investors’ appetite for risk in a potentially lower-rate environment.

Investment Strategies Moving Forward

For investors, the current market dynamics underscore the importance of diversification and the need to stay informed about global economic indicators. While gold offers a protective hedge, bonds provide a cushion against stock volatility, and stocks remain a viable growth-focused asset, balancing these in a portfolio can help manage risks and tap into potential opportunities.

Conclusion

The unexpected market rally following ‘bad’ economic data on what was predicted to be the quietest day of the year serves as a reminder of the complexities inherent in financial markets. For savvy investors, staying agile and responsive to data will be key in navigating the uncertainties of 2024’s financial landscape.

Leave a Reply