Federal Reseve Rate Cut And Its Effect.

What’s going on

- Recent decision: a modest cut

In its September 2025 meeting, the Federal Open Market Committee (FOMC) cut its benchmark interest rate by 25 basis points, bringing the federal funds rate target to 4.00 % – 4.25 %.

The move was justified largely by signs of labor market softening and an increased perception of downside risks to employment.

However, inflation remains above the Fed’s 2 % goal, so caution is still warranted.

- Diverse views within the Fed

- Stephen Miran, a newly appointed Fed governor, dissented. He preferred a bigger cut (50 bps) at the September meeting.

- Other Fed officials are more cautious. Chair Powell has stressed a gradual approach, warning that too aggressive cuts might risk derailing inflation control.

- At the same time, some Fed voices (e.g. Michelle Bowman) argue that the risks to employment are now more pressing and that the Fed may need to move more decisively.

- Outlooks & market expectations

- Markets are pricing in further cuts later in 2025 (October is often cited as a likely candidate).

- The OECD suggests the Fed has room for up to three more cuts, potentially bringing rates down toward 3.25–3.50 % by spring 2026.

- Some analysts caution that markets may already be pricing in more cuts than the Fed is comfortable delivering, given inflation risks.

📈 Implications & key risks

- On inflation: The Fed still has to balance fighting inflation with supporting employment. Inflation is sticky above 2 % (e.g. core PCE is around 2.9 %)

- On employment and growth: The Fed seems to see the labor market as the more vulnerable leg right now. Softening job growth is weighing on their view.

- On markets / assets:

- Lower rates are generally favorable to equities (especially growth / tech) and can spur borrowing / investment. BlackRock

- Bonds may rally in the short term, especially intermediate maturities, as yields fall with the easing cycle.

- The U.S. dollar may also come under pressure, boosting foreign assets for U.S.-based investors.

- On expectations vs. reality: If the Fed underdelivers (i.e. cuts less or slower than markets hope), that could spook markets or lead to “bond tantrums.” On the flip side, overcutting could reignite inflation.

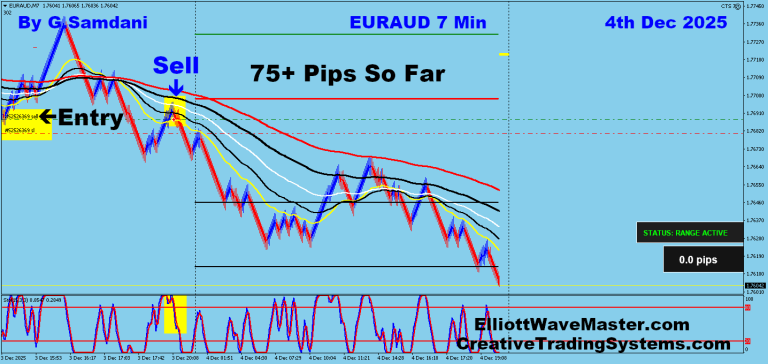

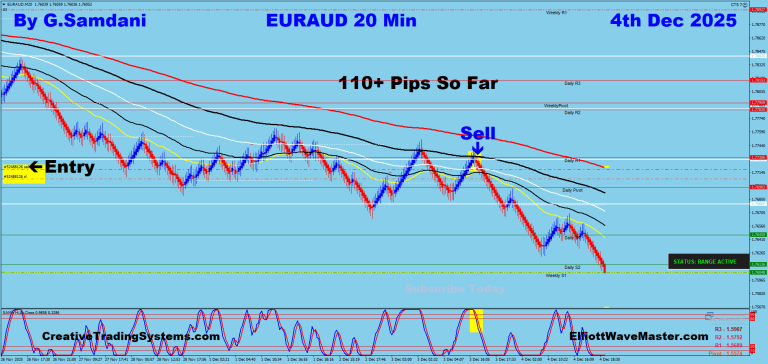

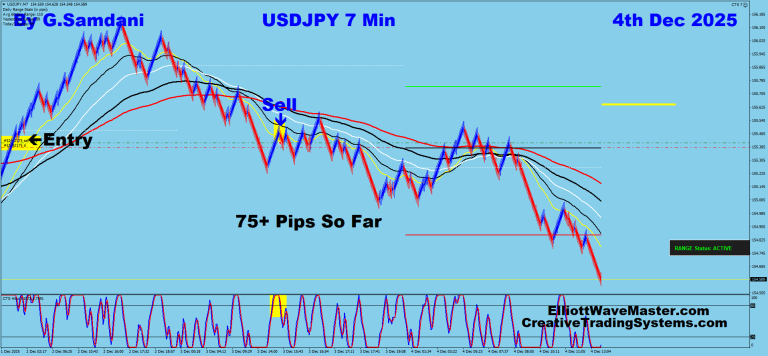

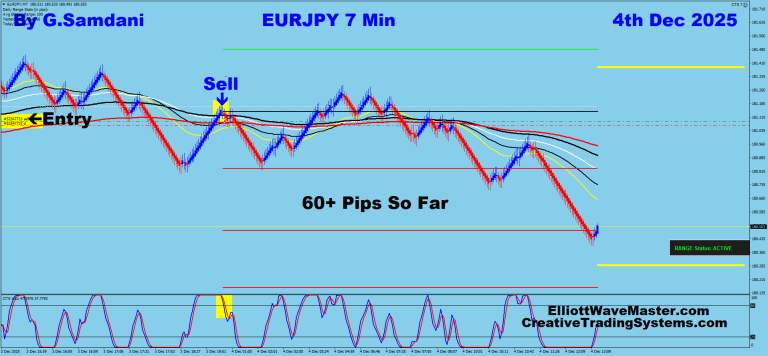

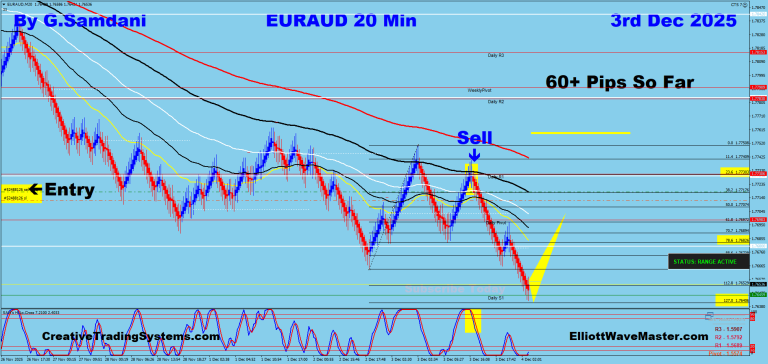

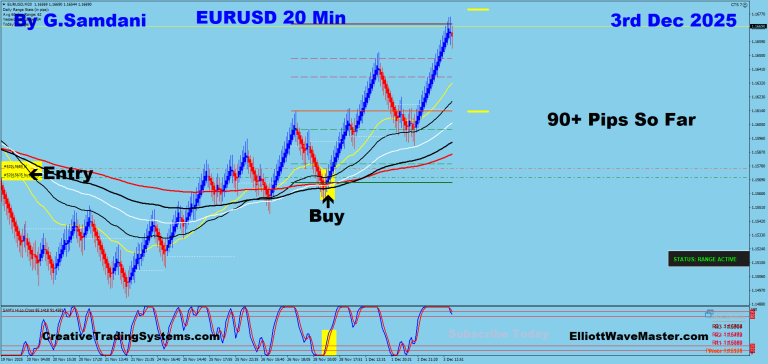

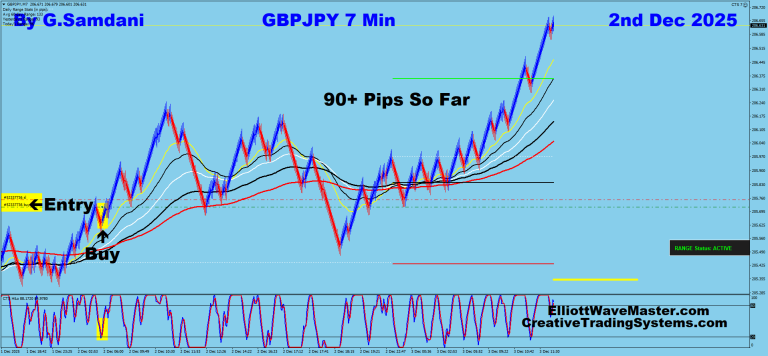

Most Recent Trades